In today’s fast-paced world, the relationship between service providers and their patrons is often challenged by complexities in monetary transactions. The experience surrounding payments and account management can frequently lead to misunderstandings and dissatisfaction. As businesses strive to enhance their offerings, a fresh perspective on these interactions becomes crucial for fostering a harmonious connection.

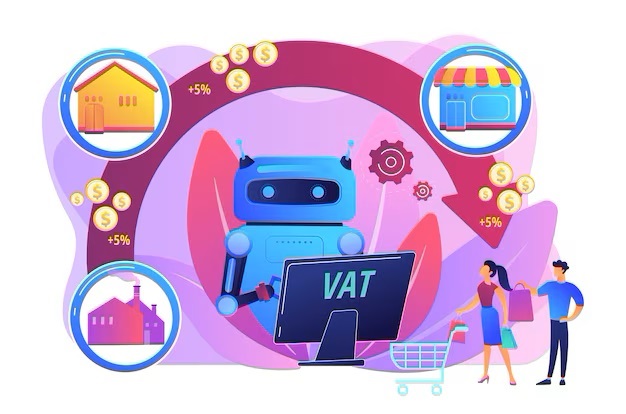

Emerging technologies are paving the way for innovative approaches that streamline monetary processes, turning potential stumbling blocks into seamless experiences. By harnessing the power of automated systems, organizations are in a position to redefine the way transactions occur, ultimately enhancing overall satisfaction. This shift not only eases tensions but also cultivates a sense of trust and reliability.

The introduction of advanced computational tools offers the chance to address common pitfalls in financial exchanges. By analyzing patterns and anticipating needs, these smart solutions can provide a more tailored approach, ensuring that necessary information reaches patrons promptly and accurately. As a result, the once daunting aspects of financial management can transform into smooth, efficient operations.

Understanding Client Frustrations in Billing

In the realm of financial transactions, there exists a notable disconnect that often leads to dissatisfaction among consumers. Grasping the intricacies behind this dissatisfaction is essential for businesses striving to enhance their service delivery. Many individuals experience stress related to monetary exchanges, stemming from a variety of factors that can significantly impact their overall experience.

Lack of transparency is frequently cited as a primary concern. When customers are unable to easily comprehend charges or the reasoning behind fees, confusion ensues. This opacity can lead to feelings of mistrust towards the service provider.

Inaccurate invoicing is another common issue that breeds annoyance. Errors in billing can disrupt financial planning and lead to unnecessary disputes. Such inaccuracies compromise the integrity of the established relationship, making it imperative for businesses to focus on precision in their financial communications.

Delayed communication regarding charges and updates can also aggravate users. When individuals are left in the dark about upcoming expenses or changes in pricing, anxiety can mount. Consumers desire proactive engagement from organizations to feel valued and informed regarding their financial commitments.

Ultimately, understanding the emotional landscape surrounding financial interactions is vital. Businesses that proactively address these concerns can foster a more harmonious relationship, ensuring that transactions are not a source of anxiety but rather a seamless component of their service experience.

The Role of AI in Streamlining Processes

Artificial intelligence plays a pivotal role in enhancing operational efficiency across various industries. By automating repetitive tasks and analyzing vast amounts of data, AI technologies contribute to more effective workflows and reduced operational burdens. Organizations adopting these innovations often observe a significant decrease in time-consuming activities that previously led to bottlenecks.

Through intelligent automation, businesses can effortlessly manage complex processes that involve numerous stakeholders. AI-driven solutions facilitate seamless interactions, ensuring that tasks are executed promptly and accurately. This not only optimizes resource allocation but also enhances the overall performance of teams working towards a common goal.

Moreover, the integration of machine learning algorithms allows for real-time data analysis, enabling organizations to adapt swiftly to changing circumstances. By leveraging predictive analytics, companies can foresee potential issues and proactively mitigate them, thus creating a more resilient operational framework. The utilization of AI technologies fosters a culture of innovation, empowering teams to focus on high-value activities while routine tasks are efficiently managed.

Enhancing Transparency with Automated Invoicing

In today’s fast-paced business environment, the significance of clarity in financial transactions has never been more crucial. Automated invoicing systems pave the way for organizations to offer a clear and straightforward experience when it comes to payment processes. By harnessing technology, companies can provide their stakeholders with detailed information, fostering a greater sense of trust and understanding.

Streamlined Processes

Integrating automation into invoicing allows for tasks to be executed efficiently and with precision. Automated systems generate invoices promptly, including essential details such as itemized charges and payment terms. This meticulous breakdown enhances the visibility of the process, enabling partners to grasp the reasons behind each charge. When questions arise, having immediate access to comprehensive records can significantly ease concerns.

Real-time Updates

Another advantage of automated invoicing is the provision of real-time updates regarding the payment status. Stakeholders are promptly notified when invoices are generated, sent, or paid. This proactive communication not only eliminates uncertainty but also allows for better financial planning, ensuring all parties are aligned throughout the transaction lifecycle.

Reducing Errors through Intelligent Data Management

Managing information accurately is crucial for enhancing operational efficiency and maintaining strong relationships. The introduction of advanced technologies that harness intelligent data practices offers a promising pathway to minimize inaccuracies that can disrupt processes and lead to dissatisfaction. By leveraging sophisticated algorithms and machine learning, organizations can transform their data handling to ensure greater reliability and precision.

Automated Data Validation

Automated systems equipped with intelligent validation capabilities help in cross-checking information against multiple sources. This proactive approach identifies discrepancies and rectifies them before they escalate into more significant issues. By streamlining these checks, businesses significantly diminish the risk of human error while fostering greater trust in the data utilized across various platforms.

Real-time Monitoring and Analytics

Employing real-time analytics allows for continuous observation of data integrity throughout its lifecycle. By analyzing patterns and trends as they unfold, organizations can rapidly detect anomalies and respond promptly. This vigilant oversight not only boosts accuracy but also enhances decision-making processes, empowering stakeholders to act swiftly based on reliable insights.

Improving Communication via Chatbots

In the digital age, maintaining seamless interactions is essential for any organization. Advanced technologies such as chatbots can play a significant role in enhancing dialogue between service providers and their users. These automated systems are capable of responding instantly, offering timely information, and ensuring a smoother engagement process.

24/7 Availability

One of the most significant advantages of implementing chatbots is their ability to operate around the clock. Clients often have questions or require assistance outside standard business hours. With chatbots in place, concerns can be addressed immediately, leading to heightened satisfaction. This ongoing accessibility fosters trust and enhances the overall relationship between the provider and their audience.

Personalized Responses

Chatbots are not merely tools for generic inquiries; they can be designed to deliver tailored responses based on previous interactions. By utilizing machine learning algorithms and data analysis, these systems can understand user preferences, anticipate needs, and provide contextually relevant information. This level of personalization makes conversations feel more engaging and meaningful, which can transform user experience dramatically.

Customizing Client Experiences with AI Solutions

In an increasingly complex marketplace, the need for tailored interactions has never been more critical. Personalization not only enhances satisfaction but also fosters long-lasting relationships. By leveraging advanced technologies, businesses can create unique, engaging experiences that resonate with individual preferences and needs.

Benefits of Personalization

- Increased Satisfaction: Tailored services create a sense of value among users.

- Enhanced Loyalty: Personalized attention encourages repeat business and referrals.

- Improved Communication: Understanding preferences allows effective interaction and feedback.

Implementing AI for Unique Experiences

- Data Analysis: AI systems can analyze vast amounts of information to identify patterns and preferences.

- Dynamic Offers: Algorithms can generate personalized promotions based on user behavior.

- Responsive Support: Intelligent chatbots provide immediate, tailored responses to inquiries.

- Feedback Integration: Continuously improving services based on user feedback enhances personalization.

By incorporating AI techniques, organizations not only address the diverse needs of their audience but also foster an environment of trust and understanding, ultimately driving success in their operations.

Q&A: Can ai end client frustrations over billing

How can AI streamline the billing process for businesses?

AI can streamline the billing process by automating repetitive and time-consuming tasks such as invoice generation, payment tracking, and reconciliation. With machine learning algorithms, AI can analyze patterns in billing data, helping to predict when clients are likely to pay and identifying potential issues before they escalate. Additionally, AI can integrate with existing accounting systems, ensuring that all financial data is updated in real-time, thus reducing human errors and speeding up the overall billing process.

What specific client frustrations related to billing can AI address?

AI can address several common client frustrations, such as unclear invoices, payment delays, and lack of personalized communication. By utilizing AI-driven chatbots or virtual assistants, businesses can provide instant responses to billing inquiries, clarify charges, and resolve disputes more efficiently. Moreover, AI can generate detailed, easy-to-understand invoices that break down charges, reducing misunderstandings. Lastly, AI can help in predicting and automating payment reminders, ensuring clients are informed without feeling overwhelmed.

Are there any risks associated with using AI for billing?

While AI offers significant advantages, there are potential risks to consider. One major concern is data privacy, as billing processes often involve sensitive client information. Businesses must ensure that they comply with relevant regulations, such as GDPR, and implement secure data handling practices. Additionally, relying heavily on AI could lead to over-automation, potentially reducing the personal touch that clients value in business relationships. It’s crucial for companies to find the right balance between automation and human interaction.

How can businesses ensure a smooth transition to AI-driven billing systems?

To ensure a smooth transition to AI-driven billing systems, businesses should start by conducting a thorough needs assessment to identify specific billing challenges. This assessment can inform the selection of appropriate AI tools that are scalable and user-friendly. Training staff on the new system is also crucial; employees should understand how to work alongside AI tools effectively. Furthermore, businesses should monitor the implementation process closely and gather client feedback to address any issues promptly, allowing for continuous improvement of the billing experience.

What insights did Sharon Scenna of Intapp share regarding the potential role that AI can play in improving client billing along with best practices for law firms?

Sharon Scenna of Intapp discusses the potential role that AI can play in improving client billing by automating and streamlining complex billing practices. With firms increasingly turning to AI to optimize revenue and client satisfaction, Scenna highlights how generative AI can support law firms in ensuring accuracy around billing practices. Through better data governance and a secure ecosystem for handling client data, firms can leverage AI for real-time billing and exceed client expectations. Best practices that come with AI deployment include effective use case selection and measures in place for privacy policy compliance to capture value without compromising data privacy.

What does Intapp recommend as best practices for finance teams looking to deploy generative AI in billing and client conversations?

Finance at Intapp underscores the importance of integrating good processes and management in AI-powered billing solutions to help law firms capture value and enhance customer satisfaction. The use of generative AI, particularly in real-time billing adjustments and client conversations, enables finance teams to exceed responsiveness standards while reducing churn. By deploying an end-to-end AI ecosystem with proper data governance and a strong point of contact for customer data, firms can ensure accurate billing practices. Key performance indicators (KPIs) and input from senior solutions management directors should guide deployment for a seamless and cost-effective AI integration.

How are legal platforms like Westlaw Today adapting to the AI-driven shift, and what role do APIs play in enhancing client billing?

Platforms such as Westlaw Today are increasingly incorporating AI and generative models like GPT-4 to support billing accuracy and client-focused solutions in the legal and financial services sectors. By enabling APIs that facilitate seamless data extraction from client interactions and service teams, these platforms offer law firms tools to exceed client expectations and improve real-time responsiveness. APIs also serve as repositories for client billing data, allowing finance teams to ensure they get billing right and align billing practices with client needs. This AI-powered approach not only enhances the scope of client engagement but also supports data governance and compliance with best practices in user agreements.

What practices do firms implementing AI need to be aware of to ensure seamless API integration, and what challenges are they likely to face?

Firms are turning to AI to streamline operations, especially through API integrations, where they can harness the technology’s real-time data capabilities. Notably, some practices that come with the use of gen AI involve ensuring that billing is accurate; however, it’s hard to say if they always get billing right. In addition to billing, the costs associated with AI-powered call centers can be high, with potential for up to a 20 percent increase. When firms migrate to gen AI-driven systems, they must account for a variety of considerations: maintaining message cadence, minimizing inbox overflow, and effectively using messaging apps. The use of Thomson Reuters’ real-time solutions, for instance, could potentially supersede traditional methods, and Reuters’ expertise in data extraction enhances AI-driven insights. January 25, 2024, is expected to mark a significant launch in AI offerings. While LinkedIn data from 2023 shows firms migrating en masse, some businesses still lack sufficient detail in the use of the technology, which may impact the cadence and clarity of internal messaging.

How does Thomson Reuters ensure their clients make sure they get billing right?

Thomson Reuters employs advanced technologies and practices that come with use to streamline the billing process. They utilize a real-time bot to extract and analyze data, ensuring clients can promptly address any discrepancies. By integrating chat support, they provide immediate assistance, making sure they get billing right and allowing clients to still make necessary adjustments. We’re seeing significant improvements in client satisfaction as a result of these measures, as clients no longer have to expect anything less than precise billing solutions.

How does the use of technology facilitate prompt responses in real time?

Technology enables organizations to streamline communication and data processing, allowing for prompt responses in real time. By utilizing advanced software solutions, teams can monitor situations as they unfold, ensuring that information is quickly analyzed and acted upon. This immediacy enhances decision-making, improves customer service, and fosters a proactive approach to problem-solving, ultimately leading to more efficient operations.